New standard simplifies subsidiary financial reporting

Last week the International Accounting Standards Board (IASB) launched IFRS 19, a new accounting standard designed to simplify reporting for subsidiaries without public accountability. This new standard allows eligible subsidiaries to utilise the IFRS framework but with reduced disclosure requirements.

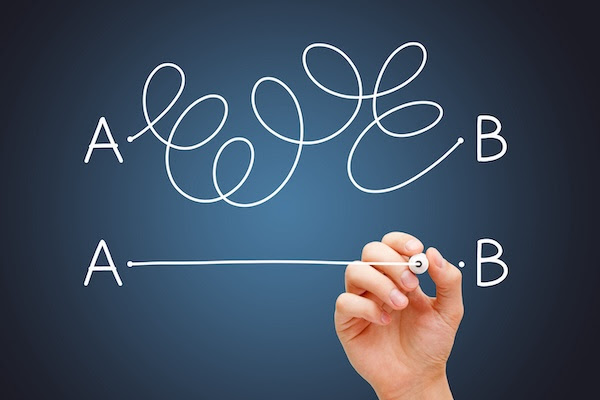

The goal is to simplify the reporting process while ensuring the relevance and utility of the disclosed information.

IFRS 19 is designed to address the cumbersome dual accounting requirements many subsidiaries face when they are obligated to adhere to IFRS reporting requirements for their consolidated reports and potentially different national accounting standards for their individual reports. Subsidiaries have often found themselves maintaining separate records to comply with different standards, leading to inefficiencies and increased operational costs.

Subsidiaries that do not have public accountability and whose parent companies report under IFRS are eligible for the new standard. IFRS 19 seeks to unify reporting requirements between the subsidiary and parent company, providing clarity and consistency across financial reports within a group. By allowing these subsidiaries to maintain a single set of accounting records, IFRS 19 not only simplifies the accounting process but significantly reduces the costs associated with financial reporting.

Andreas Barckow, Chair of the IASB, emphasised that IFRS 19 ‘reduces costs in the financial reporting ecosystem and simplifies reporting by permitting the global financial reporting language to be applied throughout the group.’

The IFRS 19 standard is immediately available for use, pending jurisdictional endorsement.

For further details on IFRS 19 and access to implementation resources, visit the IFRS website.