Case Study In The Changing Use of Structured Data: Lease Accounting

This is the seventh in a series of guest posts from Mohini Singh, ACA, Director, Financial Reporting Standards, CFA Institute.

In my latest paper, Data & Technology: How Information Is Consumed In The New Age, we take a deep dive into how structured data is being consumed and refute the claim by some that structured data is not being meaningfully utilized.

The breadth of the subject matter precludes easy or useful summary, but here we draw from the paper an example of how an investor or analyst can better understand operating leases as a result of structured data. Of note, accounting for leases are slated for significant changes with FASB Accounting Standards Update 2016-02. Operating leases do not now appear on the balance sheet, however, starting December 2018 when the new standard becomes effective, companies will have to include these lease liabilities.

Calcbench, which develops financial analysis tools, conducted a study to determine the impact this change will have on firms’ balance sheets. Calcbench is representative of a number of data providers that have materialized. These data providers have advanced the usefulness of structured data by designing analytical tools around the structured data that companies offer in their regulatory filings. These providers increase user capabilities and analytical reach by orders of magnitude. In the case of lease accounting rule changes, Calcbench, using its own analytical tools, was able to assess the impact of these changes because its platform provides:

- Access to every lease footnote filed to the SEC

- Term structures of leasing arrangements

- Sector-level summaries

- Changes in leasing obligations over time.

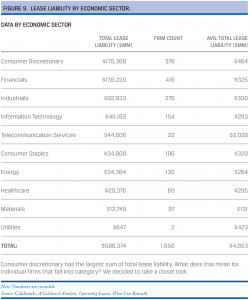

In its study, Calcbench used an Excel template to analyze the present value of all lease obligations across firms and sectors. The firm then used a discount function with an interest rate of 3%, which was scaled by 50 basis points per year to calculate total lease liabilities for more than 1,500 companies. Their work revealed that:

- Once FASB Accounting Standards Update 2016-02 becomes effective, firms will be required to add some $586 billion in debt through operating leases to their balance sheets.

- Consumer discretionary is the biggest lessee, meaning this sector will be most affected by the new FASB standard; and

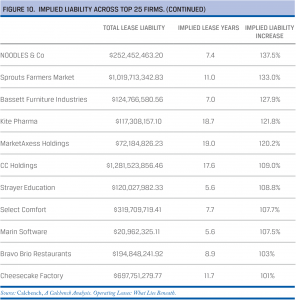

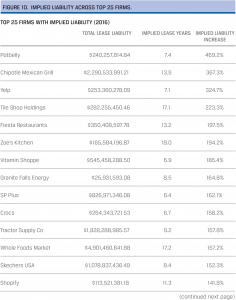

- More than 25 firms will have under-reported their leasing liabilities by more than 100% (see chart below).

This is an example of the types of analysis that large-scale structured filings in XBRL (and soon, Inline XBRL) facilitate, and shouldn’t be read as a specific endorsement of one particular vendor over another. Structured data means that investors can now extract exceptionally useful information that can drive decision making, directly from notes to the accounts, significantly expanding the utility of financial statement disclosure.