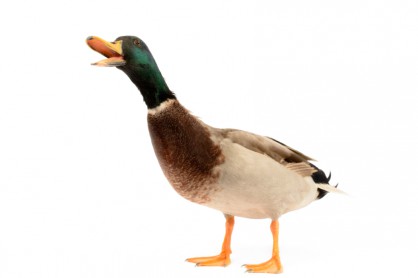

How do you Regulate a Duck?

Any time transformative financial technologies emerge, questions of how to regulate them soon follow. John Williams, the president of the US Federal Reserve Bank in San Francisco recently opined that while FinTech start-ups in the US (and we might add everywhere) have enormous potential to remake the financial services industry, they should expect to be regulated like old-fashioned banks. He used the idiomatic phrase, “If it walks like a duck and quacks like a duck, it should be regulated like a duck”.

We operate in the regulatory world. We understand the need for strong financial regulations and XBRL is used the world over to make them more effective and data more reliable. We can’t help but disagree, however, with the notion that it is safe to assume that new technologies should be regulated in old ways. For example the whole point of Smart Contracts is that they aren’t ducks. And neither do they walk or quack like them. Once they become fully fledged (ahem) parts of the financial system, it is very likely that regulators will need to look at the way that they carry out market surveillance and systemic risk oversight in an entirely new light. New technologies demand new ways of thinking about how to best use them and how to best regulate their application. Read the article and tell us what you think. These technologies are being discussed at several upcoming events. We want your opinion!