Insights from Japan’s Digitally Tagged KAMs: 2 – Industry Trends and Interesting Outliers

This is part of a short series on initial insights from our analysis of digital KAMs data, being collected in Japan for the first time. For the first post and introduction, start here.

In the first post in this series, we began our analysis of XBRL data on Key Audit Matters (KAMs) from Japanese public companies, showing that digital tagging of KAMs is helpful in understanding audit risk in terms of broad themes.

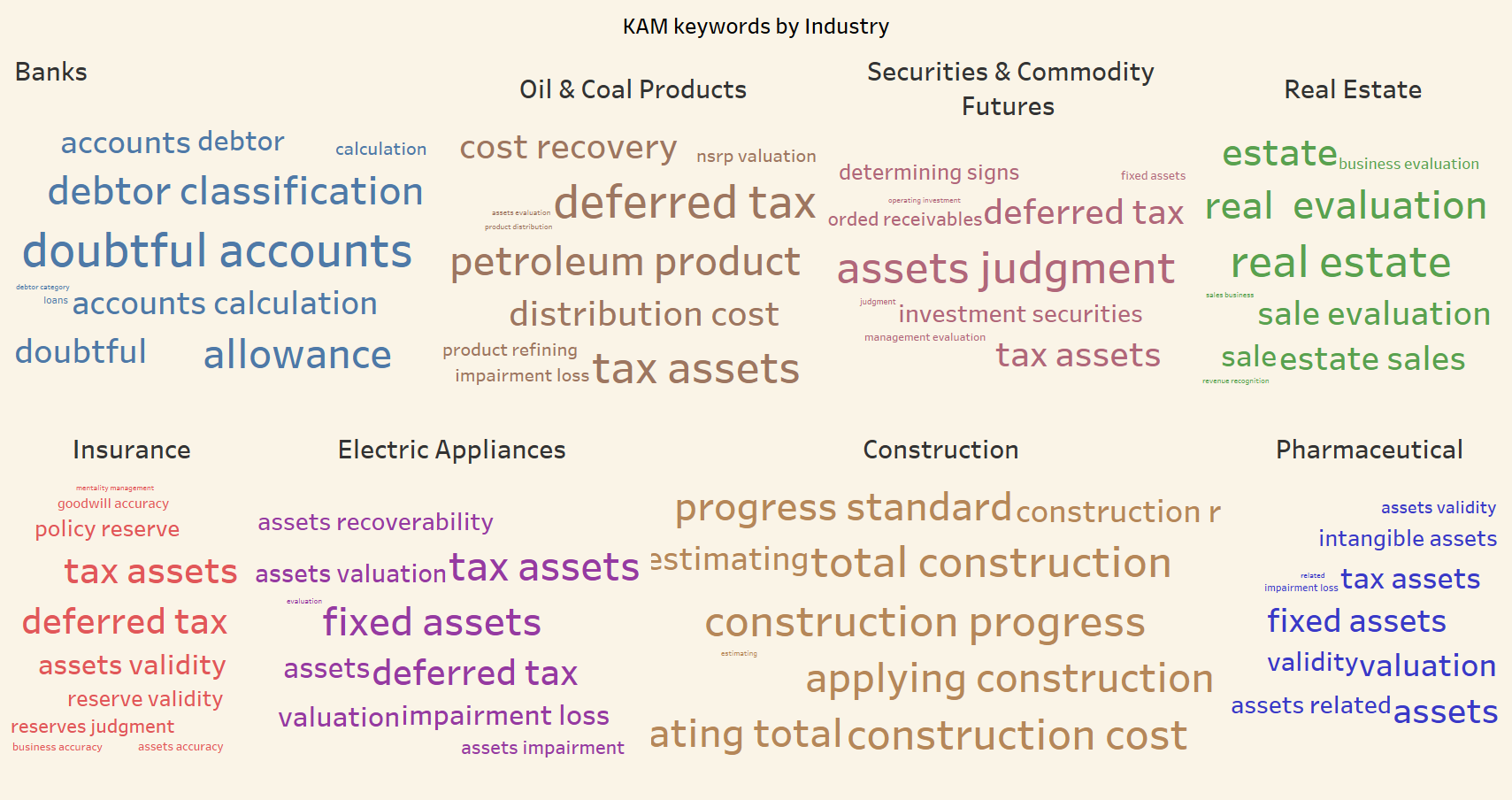

Our next step for further insight into those risks was to break the data down by industry sector. The graphic shows keywords extracted from the ‘Short Description of KAM’ tag for a number of industries. The text font size indicates the frequency of each word or phrase in the KAMs data.

This visualisation gives a gives a good, quick overview of industry-specific audit risks, and the results seem intuitive and logical. For example, in the case of Banks, ‘doubtful accounts’ stand out as the most important KAM identified by auditors, while for Real Estate ‘sale evaluation’ is an important area of audit concern.

Having determined industry-specific baselines, this analysis can be extended to identify KAMs that do not fit the usual pattern for a given industry using outlier recognition. Variations from the most common industry-specific KAMs can help analysts to spot entity-specific risk and may be of interest to investors and other users alike.

The following lists a few examples of KAMs that differ from industry trends.

| Entity | Industry | Outlying entity-specific KAM | Common industry-specific KAMs |

| 1 | Air Transportation | Validity of management’s judgment as to whether or not there is significant uncertainty regarding the going concern assumption | assets validity, fixed assets, recognition validity, impairment loss, periodic maintenance, recognizing impairment, revenue recognition, cost validity, business validity, recording periodic |

| 2 | Oil & Coal Products | Estimate of repair allowance | deferred tax, tax assets, petroleum product, distribution cost, cost recovery, nsrp valuation, impairment loss, product refining, product distribution, assets evaluation |

| 3 | Real Estate | Evaluation of IT control associated with the replacement of business processing systems related to operating revenue transactions | real estate, evaluation, real, estate, sale evaluation, estate sales, sale, business evaluation, sales business, revenue recognition |

| 4 | Pharmaceutical | Provisions and contingent obligations related to patents, etc. | assets, fixed assets, valuation, tax assets, validity, assets related, intangible assets, assets validity, impairment loss, related |

| 5 | Securities & Commodity Futures | Reserves for litigation and other legal proceedings | assets judgment, tax assets, deferred tax, investment securities, determining signs, recorded receivables, fixed assets, management evaluation, judgment, operating investment |

| 6 | Wholesale Trade | Rationality of Estimating Total Construction Costs in Applying Construction Progress Standards for Air Conditioning Equipment Construction Contracts and Made-to-Order Software | fixed assets, tax assets, assets valuation, product evaluation, valuation, evaluation, deferred tax, assets, impairment loss, assets recoverability |

KAM deviation from the industry pattern is not in itself problematic, but enables data users to discover special cases. These might represent unusual risks for investors, or even opportunities.

Digital tagging of KAMs makes analysis hugely more straightforward, and we have seen here that it enables us to gain insights at both the industry and entity level. When we consider digital data it can be easiest to imagine how to make use of numerical data – but although KAMs disclosures are text-based we can use techniques such as keyword extraction, clustering, and pattern and outlier recognition to make sense of large amounts of information and contribute to better decision-making.

Please note that the data was originally in Japanese and was translated using Google Translate, so it may well contain translation errors. It is also early days for this new tagging requirement, so we can expect some data-quality issues; we understand that the Japanese Institute of Certified Public Accountants is currently working on some relevant guidance. We thank XBRL Japan for sharing the data, enabling us to set the ball rolling with this initial analysis.