Root Cause Analysis?

At this week’s RegTech summit in London’s Canary Wharf, startups, financial institutions and several regulators convened to discuss ways to deal with the complexity, size and frequency of change in the regulation that companies face.

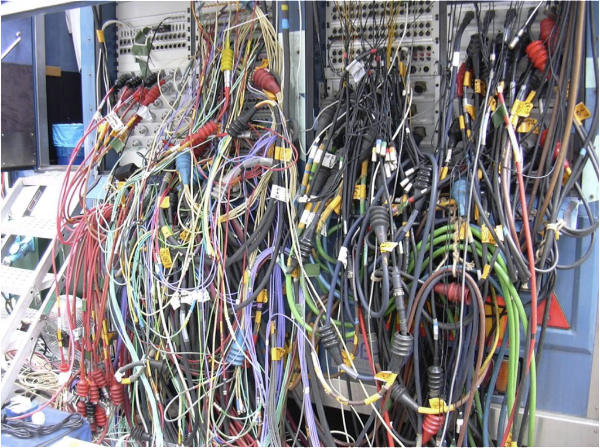

Traceability was one theme. Financial institutions have manual, project-based approaches to dealing with new rules and changes to existing rules. One factor that makes this extremely difficult is the differences in regulatory arrangements in different countries, as well as the sheer number of regulators that internationally operating companies face. One panellist from HSBC described how that bank deals with as many 40 different regulators in China alone.

What does that have to do with reporting? Providing machine readable ways to trace the lineage of regulation or rule book down to specific data requirements, (and vice versa) would help with quickly identifying the impact of changes or proposed changes. Many financial institutions feel that this could simplify aspects of implementation. Providing traceability, or comparability between reporting requirements in different domains would be really valuable. Food for thought?

There is a keynote panel on encouraging collaboration across reporting domains at Data Amplified for everyone that would like to explore this question.